SupTech Summit 2025

On November 3rd, 2025, regulators, innovators, technologists, and financial sector leaders from across the world gathered online to participate in SupTech Summit 2025. What began as a virtual meeting point quickly evolved into a global exchange of ideas, strategies, and practical solutions for the future of financial supervision.

This year’s Summit showcased how rapidly supervisory technology is advancing and how essential collaboration has become in shaping responsible and resilient financial ecosystems. More than a conference, it was a collective commitment to modernizing oversight through data, analytics, and ethical AI.

A Global Summit Designed for Accessibility and Collaboration

The 2025 edition was delivered in a fully online format to ensure broad access and international participation.

The Summit infrastructure included:

Microsoft Teams as the primary platform for keynote sessions, live discussions, and technical demonstrations.

Real-time multilingual translation in 50+ languages to support global inclusion.

A centralized digital environment for registration, broadcasting, interaction, and automated certificate distribution.

This structure ensured a seamless experience for participants across multiple regions and time zones.

A Truly International Community

SupTech Summit 2025 gathered a diverse and highly engaged audience representing both emerging and developed markets.

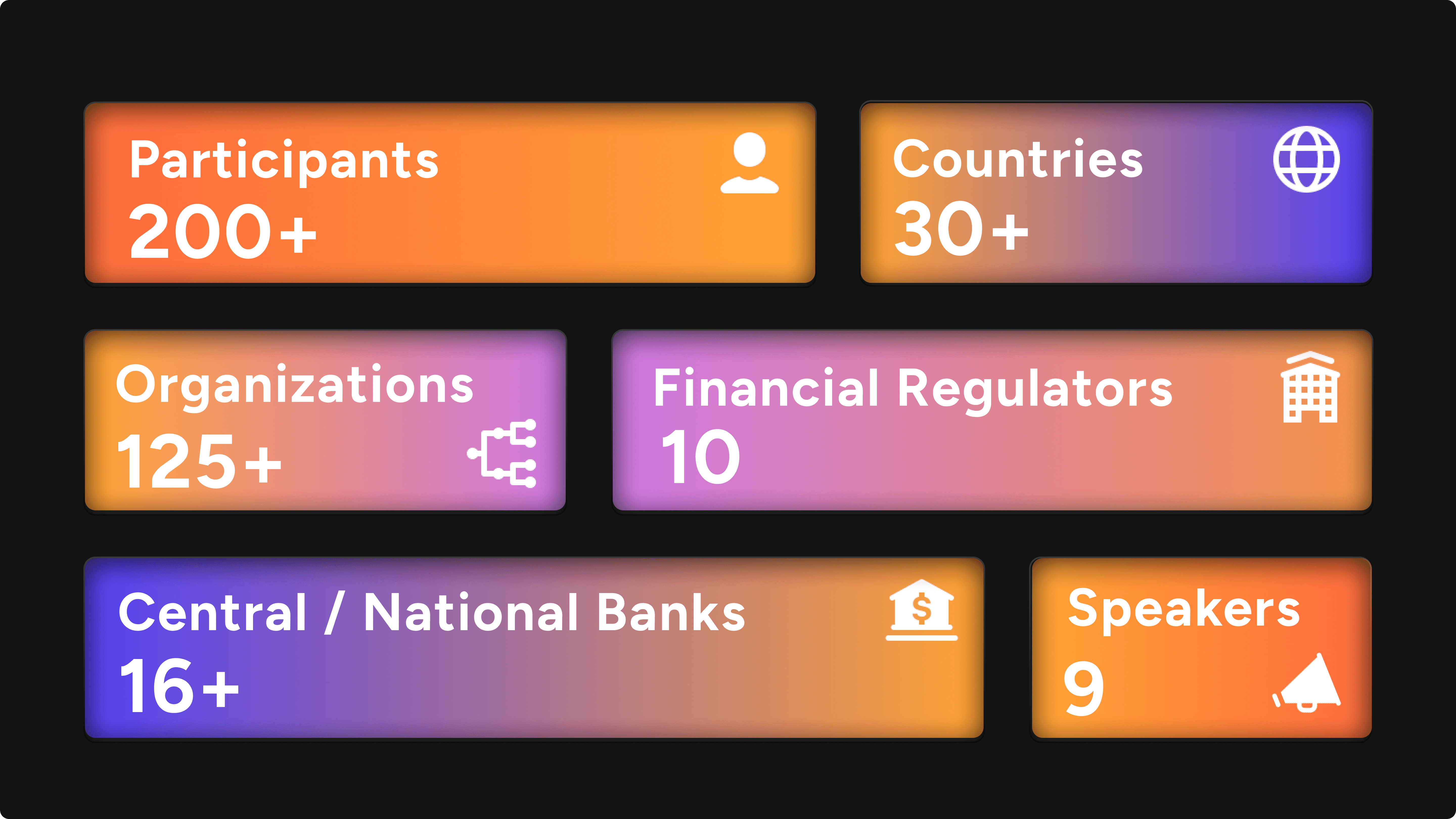

Key participation statistics:

200+ participants

30+ countries

125 institutions

16 Central and National Banks

10 Financial Regulators

47 Commercial Banks and solution providers

7 academic and research institutions

The attendance demonstrated the global momentum behind supervisory innovation and cross-border collaboration.

Distinguished Speakers and Key Topic Highlights

SupTech Summit 2025 offered a comprehensive, content-rich program featuring leading experts from central banks, academia, industry, and the broader supervisory technology ecosystem. The agenda combined strategic discussions, applied case studies, and forward-looking perspectives, delivered by professionals directly shaping the global SupTech landscape.

The program included the following speakers and thematic sessions:

Opening Remarks

Speaker: Varlam Ebanoidze, National Bank of Georgia

A formal introduction to the Summit objectives, the strategic importance of SupTech and AI in supervision, and an overview of the day’s program.

The State of SupTech Globally to Date, with Focus on AI in Supervision

Speaker: Juliet Ongwae, Cambridge SupTech Lab

A high-level overview of international SupTech developments, highlighting how AI is increasingly embedded in supervisory practices around the world.Regulatory-Aware AI in Finance

Speaker: Teimuraz Murgulia, Nastavia

A session focused on AI solutions designed with regulatory requirements in mind, touching on compliance, risk considerations, and supervisory expectations.AI in SupTech & Central Banking

Speaker: Tatia Tsiklauri, National Bank of Georgia

Insights into how AI can support SupTech initiatives and central banking operations, with an emphasis on analytical capabilities and supervisory applications.AI-Driven Transformation in Supervision

Speaker: Luka Menteshashvili, FINA

An exploration of how AI-driven tools can transform supervisory workflows, enabling more efficient analysis, monitoring, and decision support.Managing Data and Ethics in AI-Based Supervision

Speaker: Rati Barbakadze, FINA

A discussion of data management, ethical considerations, and responsible practices when integrating AI into supervisory and regulatory processes.The Future of Analytics: Power BI and AI

Speaker: Ana Dgebuadze, FINA

A practical look at how Power BI combined with AI capabilities can enhance reporting, visualization, and insight generation for supervisory authorities.Responsible AI: Balancing Innovation, Regulation, and Human Oversight

Speaker: Gigi Giorgadze, Georgian AI Association

A reflection on balancing rapid AI innovation with regulatory frameworks and the continued need for human judgment in critical supervisory decisions.Gen Z Trust & AI Reliability in Financial Sector's CX Management: Evidence from Georgia

Speaker: Nana Akhobadze, CX Hub

A session examining how Gen Z perceives AI in financial services, using evidence from Georgia to explore trust, reliability, and customer experience in an AI-enabled environment.

Collectively, these sessions delivered a holistic narrative on how supervision is transforming through intelligence, automation, and data-driven methodologies.

If you would like to access the full recording of the SupTech Summit 2025, please send your request at summit@fina2.net

Participant Experience and Community Reflections

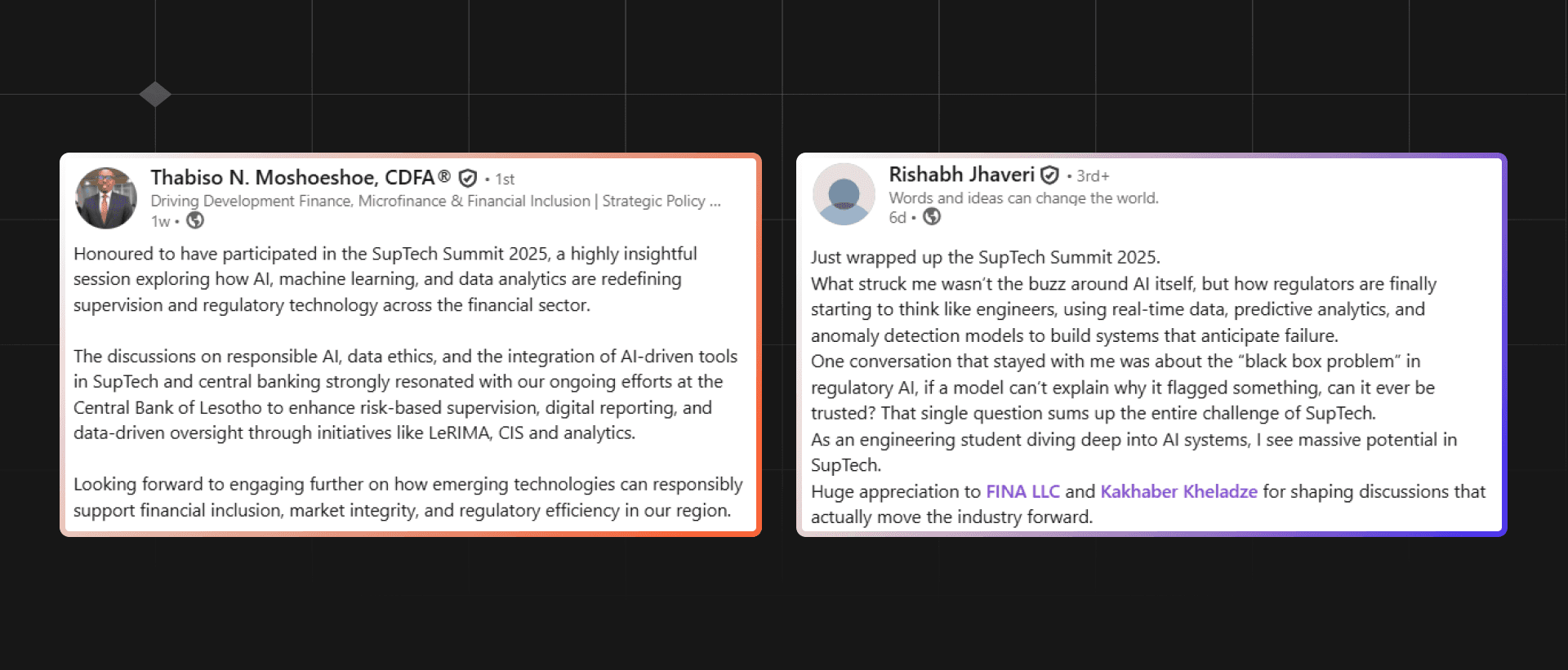

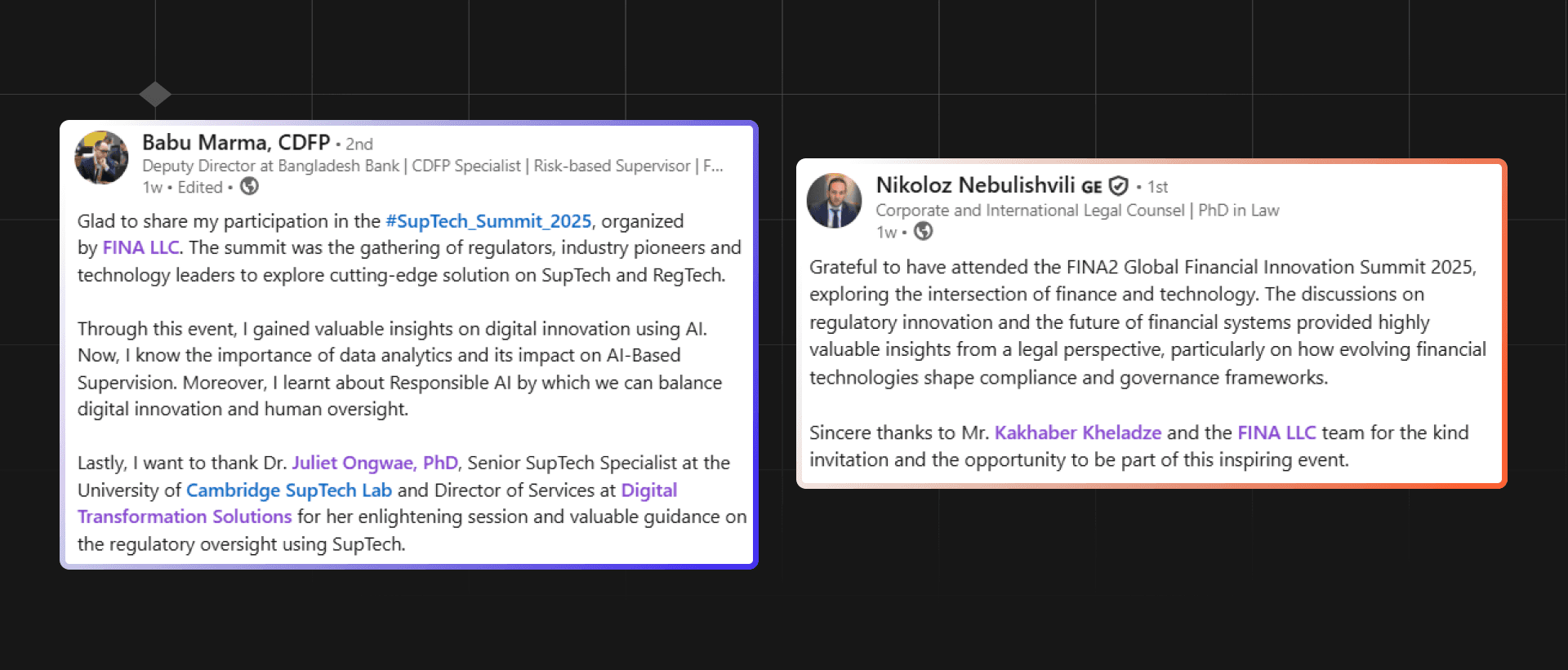

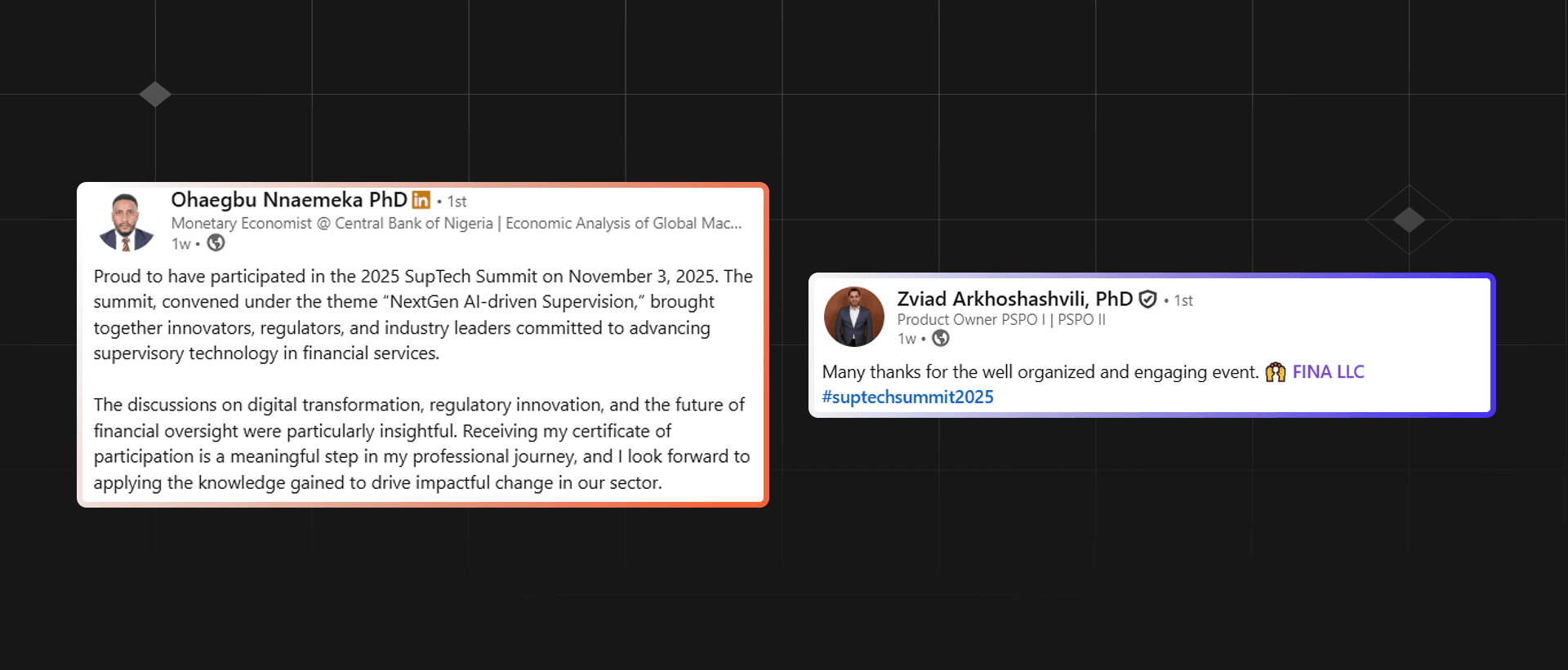

The Summit’s atmosphere was shaped by active engagement, practical dialogue, and candid discussions about the challenges facing supervisory authorities today.

To capture the insights of the participants, we have compiled a selection of feedback shared during and after the event:

This feedback continues to guide the planning of future initiatives and ensures that the Summit remains aligned with the needs of the supervisory community.

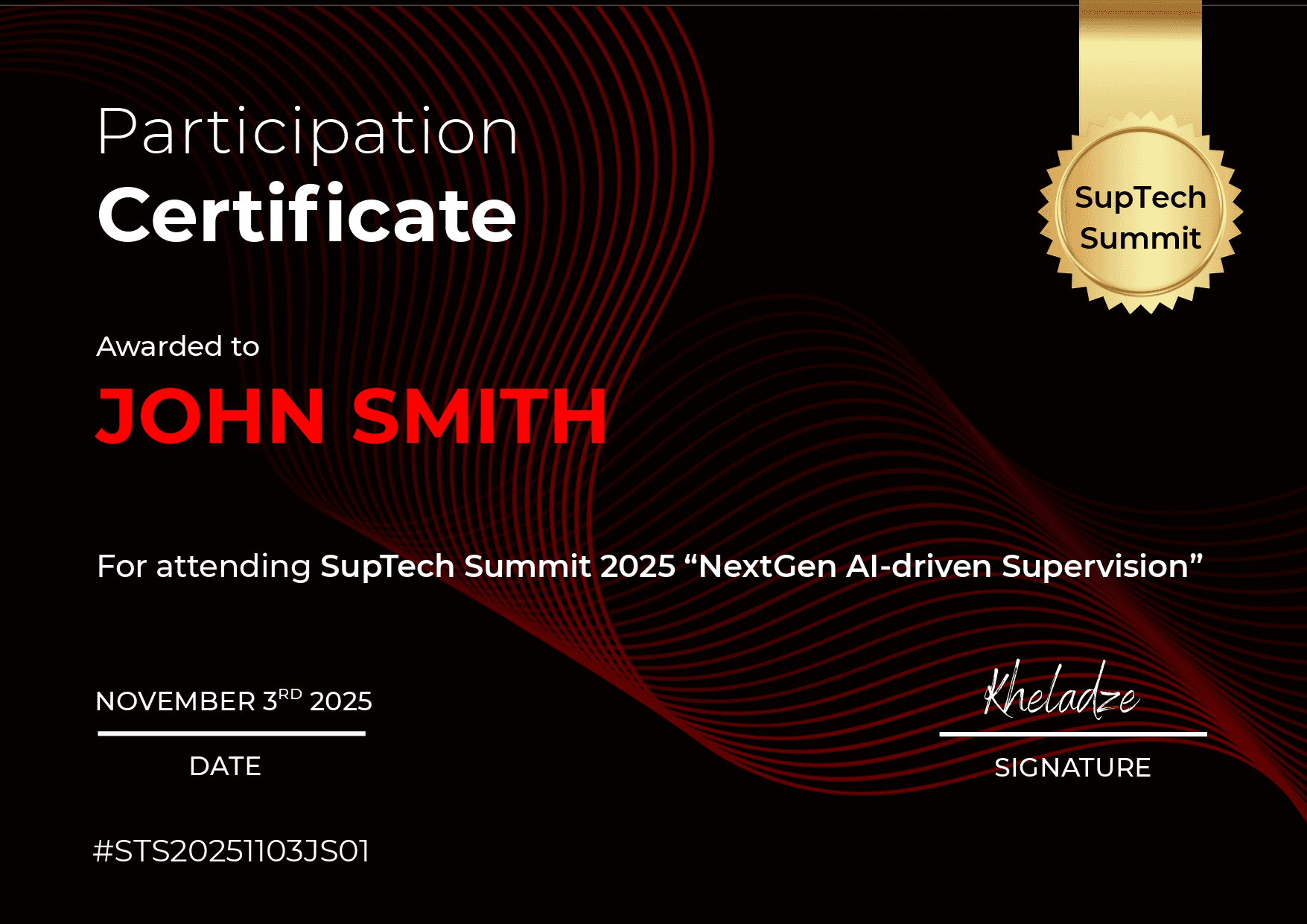

e-Certificates and Recognition

All participants received official e-Certificates of Participation. These certificates acknowledge the contribution of each attendee to the global SupTech dialogue and highlight their commitment to advancing supervisory technologies.

Preparing for SupTech Summit 2026

Preparations for SupTech Summit 2026 have already begun. The upcoming edition is planned in a hybrid format, combining online accessibility with an in-person component to ensure flexibility for participants around the world.

The themes and topics for 2026 will be selected based on the feedback received from the 2025 participants and aligned with the most relevant developments in supervisory technology, AI, data governance, and regulatory innovation. The goal is to continue strengthening knowledge-sharing, enhancing global participation, and addressing the evolving needs of central banks and supervisory authorities.